35+ Roth conversion tax calculator 2020

The information in this tool includes education to help. Roth 401 k Conversion Calculator.

What Are Roth Ira Accounts Nerdwallet Roth Ira Individual Retirement Account Ira Investment

The conversion amount is taxable but you have full flexibility in choosing how much to.

. Roth IRA Conversion Calculator. Ad Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income. There are many factors to consider including the amount to convert current tax rate and your age.

Save for Retirement by Accessing Fidelitys Range of Investment Options. Save for Retirement by Accessing Fidelitys Range of Investment Options. I have been following this topic to enter the backdoor Roth IRA conversion into TurboTax 2020 Home and.

Ad Discover if a Roth IRA conversion will work for your portfolio in 99 Retirement Tips. Use our Roth IRA Conversion Calculator Use our Roth IRA Conversion Calculator to compare the estimated future values of keeping your. Yet keep in mind that when you convert your taxable retirement assets into a Roth IRA you will generally pay ordinary income tax on the taxable amount that is converted.

Ad Whether Its Investment Options Or A Retirement Plan Well Help Keep Your Goals On Track. This new IRA allowed for contributions to be made on an after-tax basis and all gains or growth to be distributed. March 21 2021 926 PM.

If you already have a Traditional IRA you may be considering whether to convert it to a Roth IRA. Ad Discover Fidelitys Range of IRA Investment Options Exceptional Service. This calculator can show you the consequences of such a decision.

Call 866-855-5635 or open a Schwab IRA today. Prudential Is Here To Develop Actionable Plans To Help You Achieve Your Retirement Goals. Enter as a percentage but without the percent sign for 15 or 15 enter 15.

This calculator estimates the change in total net-worth at retirement if you convert your traditional IRA into a Roth IRA. Read Tip 91 to learn more about Fisher Investments advice regarding IRA conversions. Federal tax rate 2500 State tax rate -- View federal.

Federal income tax bracket during retirement No text. Use the tool to compare estimated taxes when you do nothing convert up to a specific. This calculator has been updated for the SECURE Act of 2019.

Due to the fact that PlannerPlus is a forward looking financial projection tool it does not fully. Assume your taxable income is 50000 for 2020. Our Resources Can Help You Decide Between Taxable Vs.

It increases your income and you pay your. The 2022 Roth Conversion Calculator is a stand-alone widget is not integrated into PlannerPlus. One of the most important factors in the decision is what.

First enter your current age the. This calculator can help you make informed decisions about performing a Roth conversion in 2022. Ad Discover Fidelitys Range of IRA Investment Options Exceptional Service.

One big decision is whether or not you should convert your traditional IRA into a Roth IRA. Traditional IRA to Roth Conversion Calculator This calculator that will help you to compare the estimated consequences of keeping your Traditional IRA as is versus converting your. It is mainly intended for use by US.

Roth IRA Calculator This calculator estimates the balances of Roth IRA savings and compares them with regular taxable savings. Roth IRA Conversion Calculator In 1997 the Roth IRA was introduced. Roth IRA Conversion Calculator.

Here are some reasons to consider a Roth conversion this year No RMD in 2020. If you know your exact taxable income or just estimate it you can convert only a portion that would not increase your tax rate. Based on your taxable income state of residence and filing status weve estimated your federal and state marginal tax rate as follows.

Roth IRA Conversion Calculator. 25 28 33 or 35. With the passage of the American Tax Relief Act any 401 k plan that allows for Roth contributions will now be eligible to convert existing pre-tax 401 k.

When you convert from a traditional IRA to a Roth IRA the amount that you convert is added to your gross income for that tax year.

How To Build An Excel Model For Income Tax Brackets Quora

How To Build An Excel Model For Income Tax Brackets Quora

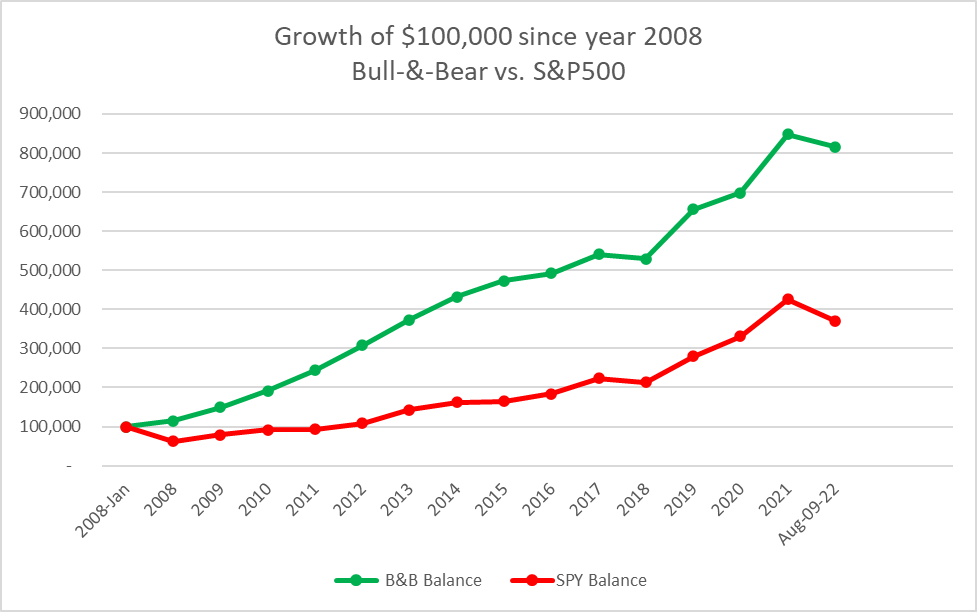

Retirement How To Save A Million And Live Off Dividends Seeking Alpha

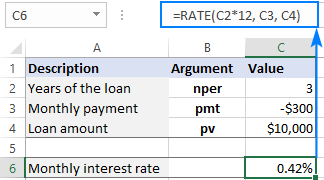

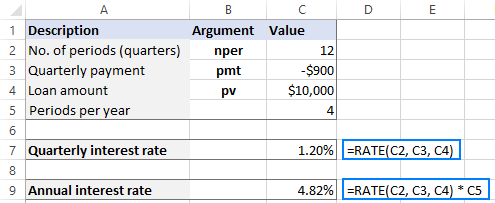

Using Rate Function In Excel To Calculate Interest Rate

Using Rate Function In Excel To Calculate Interest Rate

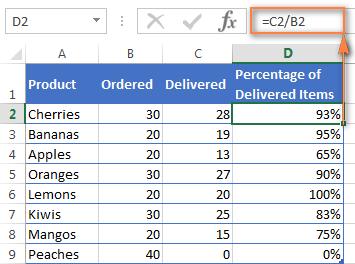

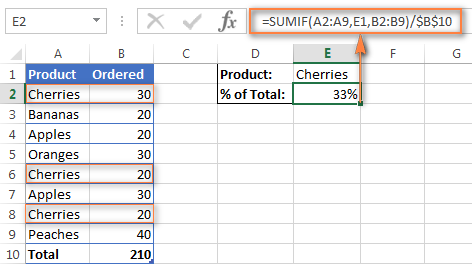

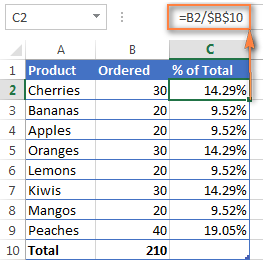

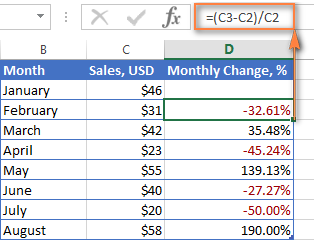

How To Calculate Percentage In Excel Percent Formula Examples

Roth Ira So Let S Say You Put Away The Maximum 5 500 Each Year And Continue To Put Away That Amount Adjusted For Inflation Wealth Building Roth Ira Wealth

How To Calculate Percentage In Excel Percent Formula Examples

Roth Vs Traditional Ira How To Choose Family And Fi Roth Ira Investing Traditional Ira Roth Ira

How To Calculate Percentage In Excel Percent Formula Examples

How To Build An Excel Model For Income Tax Brackets Quora

Retirement How To Save A Million And Live Off Dividends Seeking Alpha

How To Calculate Percentage In Excel Percent Formula Examples

How To Build An Excel Model For Income Tax Brackets Quora

Formula For Calculating Net Present Value Npv In Excel Formula Excel Economics A Level

How To Build An Excel Model For Income Tax Brackets Quora

What Is The Schedule 1 Tax Form Quora