Mortgage calculator with prepayment option

That is right you can take out a Reverse Mortgage loan that requires no monthly payments but still make payments on the loan in order to lower the balance for the. Use the Mortgage Payment Calculator to discover the estimated amount of your monthly mortgage payments based on the mortgage option you choose.

Mortgage Payoff Calculator With Extra Principal Payment Free Template

In just 4 simple steps this free mortgage calculator will show you your monthly mortgage payment and produce a complete payment-by-payment mortgage amortization schedule.

. For example lets say youre considering purchasing a 250000 home and putting 20 percent down. Once you click compute youll see how much the extra mortgage payments will save in the way of interest over the life of the loan and also how much faster youll pay off your mortgage. Free online mortgage calculator specifically customized for use in Canada including amortization tables and the respective.

20 Queen Street West Suite 1100 Toronto ON M5H 3R3 18669886324. How to get approved for a mortgage. It calculates your monthly payment and lets you include additional extra payment prepayments to see how soon you could pay off your home or how much you could save by paying less interest.

Continuing with the above example the revised mortgage amount would be 260000 8060 268060. A mortgage allows the option of building up a cash account. For an exact amount of your prepayment charge order a payout statement or call 1-888-264-6843 Opens your phone app.

If not the calculator will alert you. Also there are checks in the calculator to ensure that the inputs entered by you constitute a valid mortgage. For example a 3 prepayment penalty on a 250000 mortgage would cost you 7500.

Make payments weekly biweekly semimonthly monthly bimonthly quarterly or. You can also see the savings from prepaying your mortgage using 3 different methods. But before you make additional mortgage payments make sure to ask your lender about prepayment penalty.

Free mortgage payoff calculator to evaluate options to pay off a mortgage earlier such as. Instead your mortgage default insurance premium is added to your mortgage amount and paid off over the life of your loan. Manulife Bank mortgages allow you to annually prepay up to 20 of your mortgage without a charge.

Refinancing is not the only way to decrease the term of your mortgage. Your mortgage payment is defined as your principal and interest payment in this mortgage payoff calculatorWhen you pay extra on your principal balance you reduce the amount of your loan and save money on interest. You may be required to adjust your payments make a prepayment or pay off the balance of the mortgage.

Visit our Refinance Calculator. You can reduce the outstanding balance of your mortgage and therefore your prepayment charge by exercising your Annual Prepayment Option before you pay off the mortgage. See how refinancing with a lower mortgage rate could save you money.

You also have the option to make a higher prepayment including paying off your mortgage in full with a prepayment charge. Refinancing your mortgage can. Learn more about mortgage prepayment charges below then continue to the calculator to estimate your prepayment charge.

For example adding 50 each month to your principal payment on the 30-year loan above reduces the term by 3 years and saves you more than 27000 in interest costs. So for example if you had a 200000 mortgage you have the ability to put a 20000 lump sum. Some lenders may charge a prepayment penalty if the borrower pays the.

We are interested in any feedback you. Mortgage Calculator With PMI is a mortgage amortization calculator that has an option to include Private Mortgage Insurance or PMI. For Quebec 1-800-813-1833 Opens your phone app.

Another option available is to put 10 down yearly as a lump sum payment directly to your principal. Imagine a 500000 mortgage with a 30-year fixed interest rate of 5. Making extra mortgage payments are a good way to reduce your interest charges and shorten your term.

This lump sum is 10 of your initial value of your mortgage. Start by entering the mortgage amount. Mortgage rates are influenced by a variety of factors rather than moving in lockstep with any one economic indicator.

Most banks offer some form of mortgage payment deferral to help homeowners during difficult financial periods. Taking advantage of particular prepayment privileges that some mortgage lenders offer such as RBCs Double-Up prepayment option or BMOs 20 annual lump-sum prepayment option will also reduce your amortization period. One feature of the Reverse Mortgage loan that is not as well-known as it should be is that Reverse Mortgage loans have no prepayment penalties and homeowners can make payments on these loans.

Its a viable option if you have extra income but cannot afford to refinance to a shorter term. Or one extra month of payments every year. You can also estimate your prepayment charge with our mortgage prepayment charge calculator.

The PMI is calculated only if the down payment is less than 20 of the property value and the borrower will have to pay for the mortgage insurance until the balance is less than or equal to 80 of the home value. Early Mortgage Payoff Examples. Refinancing your mortgage can be a really valuable option.

This is how much you would need to borrow from your lender in order to purchase your home. Mortgage calculator - calculate payments see amortization and compare loans. If youre paying off your home loan well in advance those fees can add up quickly.

Use this additional payment calculator to determine the payment or loan amount for different payment frequencies. Use our mortgage refinance calculator to get an idea of how much it will cost. By paying a little extra on principal each month you will pay off the loan sooner and reduce the term of your loan.

You will be alerted if you violate any of these limits. A mortgage is high-ratio when your down payment is less than 20 of. Another option is to refinance your mortgage into a shorter loan term.

The biweekly payments option is suitable for those that receive a paycheck every. The Vertex42 Mortgage Payment Calculator is a very simple spreadsheet that lets you compare different mortgages side-by-side. Keep in mind that you may pay for other costs in your monthly payment such as homeowners insurance property taxes and private mortgage insurance PMI.

Please read these alerts to fix the inputs to ensure the input variables represent a valid mortgage. The stock market rises and falls for a wide variety of reasons including global economic and political issues but as a broad rule of thumb a rising stock market indicates optimism among investors about the economy. Which provides a person the flexibility of being able to repay all or part of a mortgage at any time without a prepayment charge or a closed mortgage.

This is the cost of the home minus the down payment. Mortgage default insurance protects your lender if you cant repay your mortgage loan. You need this insurance if you have a high-ratio mortgage and its typically added to your mortgage principal.

Mortgage Loan Prepayment Calculator

Free Balloon Loan Calculator For Excel Balloon Mortgage Payment

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Downloadable Free Mortgage Calculator Tool

Downloadable Free Mortgage Calculator Tool

Excel Mortgage Calculator Spreadsheet For Home Loans Buyexceltemplates Com

All In One Interest Only Loan Calculator Financeplusinsurance

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Mortgage Payoff Calculator With Extra Payment Free Excel Template

Extra Payment Mortgage Calculator For Excel

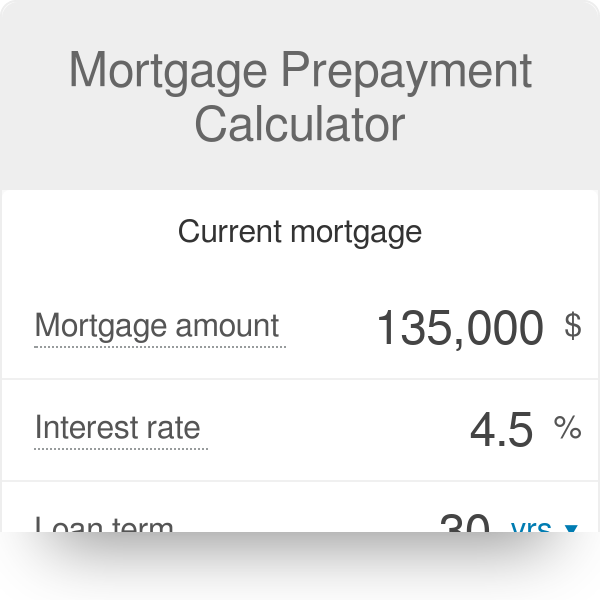

Mortgage Prepayment Calculator

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Pay Off Mortgage Vs Invest Calculator

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

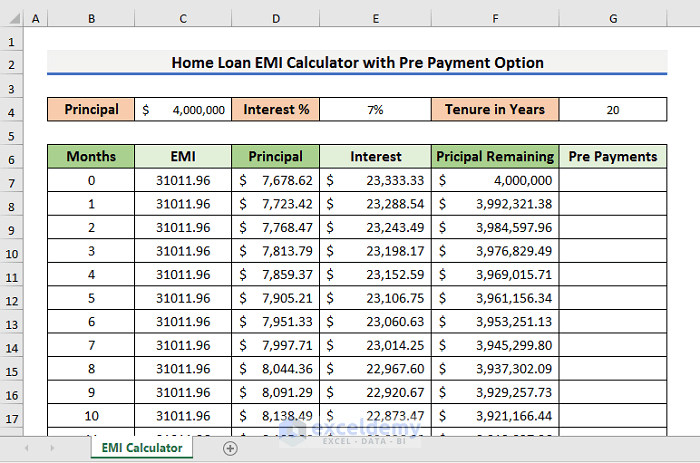

Create Home Loan Emi Calculator In Excel Sheet With Prepayment Option

Mortgage Prepayment Calculator

Mortgage Prepayment Calculator Online 55 Off Www Ingeniovirtual Com